GPU shipments increased 39% last quarter, despite shortages

Bottom line: We might be living through one of the worst periods in history to buy a graphics carte, but it'southward a boom time for GPU vendors. Co-ordinate to a new report, shipments were up a massive 38.74% yr-on-yr during the first quarter of the year.

Jon Peddie Research writes that the GPU market saw 119 million unit shipments during Q1 2022. That's up 38% compared to the same period a year earlier and down but -0.3% per centum from the previous quarter—in that location's usually a decline of effectually -7% in Q1 following the busy holiday season.

Nvidia continues to dominate the discrete GPU infinite with an 81% share, up 6% YoY. AMD'southward xix% share is down from a twelvemonth earlier, only upwardly one point compared to the previous quarter. JPR predicts the number of dGPUs will continue increasing over the side by side five years, reaching 26% of the total market, while the total GPU install base is predicted to hit iii,333 meg units by 2025.

| Q1 2022 | Q4 2022 | Q1 2022 | |

| AMD | 25% | 18% | xix% |

| Intel | 0% | 0% | 0% |

| Nvidia | 75% | 82% | 81% |

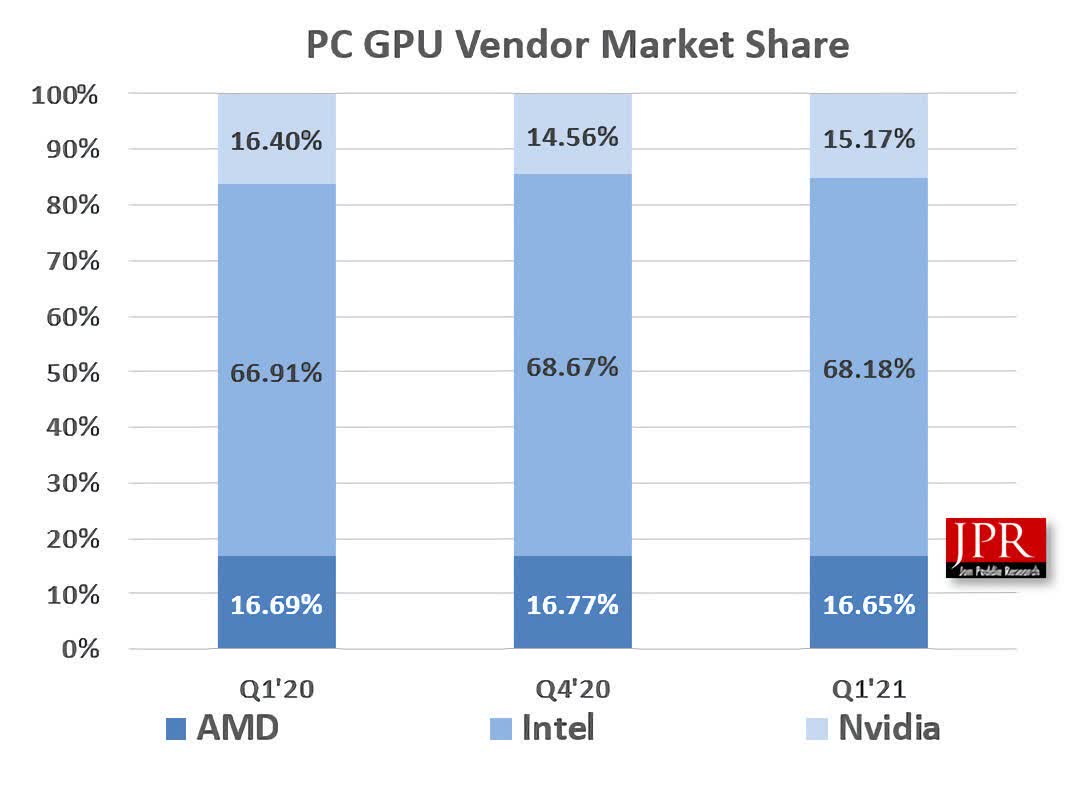

Looking at the overall market place, which includes integrated graphics, Intel remains the clear leader with a 68.18% share. Notwithstanding, squad green was the only one whose shipments increased quarter-over-quarter, up 3.9%, while both AMD and Intel saw -i% declines.

Hither are some of the report'south highlights:

- The GPU's overall attach rate (which includes integrated and detached GPUs, desktop, notebook, and workstations) to PCs for the quarter was 117%, up 4% from last quarter.

- The overall PC CPU market decreased by -iv% quarter-to-quarter and increased 39% year-to-year.

- Desktop graphics add-in boards (AIBs that utilise discrete GPUs) increased by vii% from the last quarter.

- This quarter saw no change in tablet shipments from last quarter.

Elsewhere, the number of people however working and learning from home helped notebooks exceed a record 89 million unit of measurement shipments during the first quarter, with YoY growth at 49%. And this is despite companies such as Acer alert of laptop supply problems acquired by the flake shortages. Shipments are expected to ho-hum down throughout the year, with growth dropping to iv% in Q2, and that could spell problem for overconfident device makers.

"The gamble is that semiconductor suppliers volition be lured into over-reaction and believe that suddenly 100s of millions of new users accept appeared and the demand will stay high. That's not only not realistic, information technology's besides not true—where are they coming from—non this planet?" said JPR president Jon Peddie.

While this is all skilful news for vendors, consumers keep to struggle to find graphics cards, especially at the MSRP, and things are unlikely to meliorate someday soon. Flex, the world's third-biggest electronics contract manufacturer, says that the current chip shortage could last until 2023.

Source: https://www.techspot.com/news/89978-gpu-shipments-increased-39-last-quarter-despite-shortage.html

Posted by: kittconew2000.blogspot.com

0 Response to "GPU shipments increased 39% last quarter, despite shortages"

Post a Comment